The Agenda Behind the Import and Export of Oil Reserves

Uncategorized August 28, 2019, Comments Off

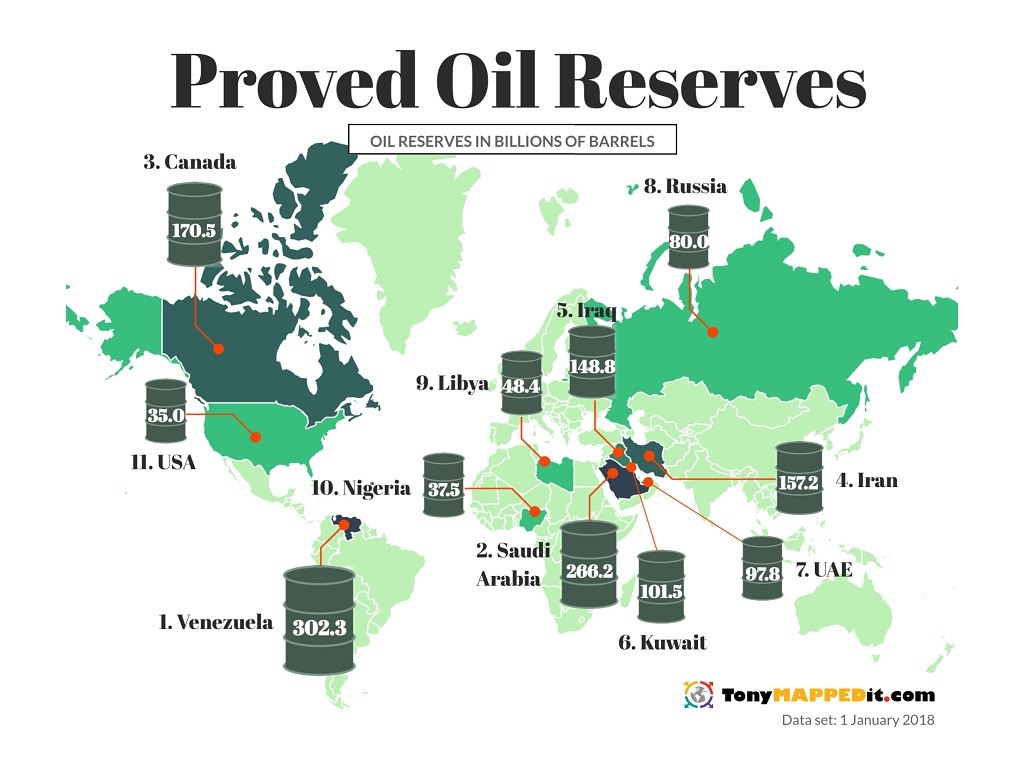

The most prevalent economic commodity that has garnered an array of economic crises and is continually spurring debates over efficient usage of non-renewable resources is, unquestioningly, oil. The reason for its mass usage is a list which cannot be shortened, but simply summarised, for oil is a commodity that plays a fundamental key in the production process of an economy, regardless which one, as depicted by the oil map of the world.

The United States of America is knighted to be the largest oil-producing country, with about 15 millions of crude oil barrels produced per day, while Saudi Arabia leads in the second position. The reputation of these two countries in the matter of crude oil production and trade is not unheard of, but often times, it becomes questionable as to what exactly benefits them through the mass production of this specific commodity. And even more surprising stands the fact that the United States also participates in the import of this particular good, where about 7.9 million barrels of crude oil is imported per day. Eventually, it begs the question for why such countries put so great of an importance over the trade of oil.

Crude oil denotes to the oil that is extracted directly from oil reserves and lacks the necessary refinement and processing to be generated into the oil for commercial use. The market for the trade of such oil is completely oversaturated as well as largely volatile, and therefore, trade can be significantly profitable or incredibly ineffectual. But, even with the temperamental prices of oil, it is still a global commodity and a necessary one at that, therefore, attaining continuous demand in the market and being positioned as the world’s most traded resource. Therefore, for an oil producing country to enter the market and trade the commodity, their economy reaps staggering financial gains. Trade is the rudimentary gear for any economy to perfectly prosper in their economic growth, and therefore, trading in a market as lucrative as the oil market brings an economy enormous monetary inflow that can be used for economic development.

On the other hand, the United States being a large importer of oil is rationalised by a few considerations, one of them being that the United States chiefly participates in the production of light crude oil. The processing of such a form of oil requires heavy expenditure and large investments over the production and manufacturing of new infrastructure. This ultimately brings about a burdening problem that the United States is not eager to face. Therefore, their procedure pertains to the exporting of light crude oil to countries that have the facility to refine this particular commodity for domestic usage, and import heavy crude oil for their economic use. This puts them at the advantage of not having to deal with the cost of extending oil reserves to preserve their extracted oil as well as allocate an efficient level of light oil for US domestic producers to use and enjoy for productive purposes. It also enables them to sell oil at prices that benefit local consumers and producers while gaining the financial advantage from exporting the additional oil reserves.

Oil pricings are also a format to spur certain economic conflicts, be they deliberately purported or stirred consequentially through discriminatory prices. The latter would denote to a country selling oil to another in a reduced or discounted level due to preference or covert economic agreements, therefore causing other buyers from that specific country to riot. Therefore, regardless whether it is used in trade or to act out certain economic processes, oil is significantly relevant as well as pivotal for the movement of an entire economy.